Some Ideas on Pacific Prime You Need To Know

Some Ideas on Pacific Prime You Need To Know

Blog Article

The Buzz on Pacific Prime

Table of ContentsHow Pacific Prime can Save You Time, Stress, and Money.Pacific Prime Fundamentals Explained6 Simple Techniques For Pacific PrimeFacts About Pacific Prime UncoveredThe Pacific Prime Diaries

Insurance is an agreement, stood for by a policy, in which an insurance policy holder gets financial defense or compensation against losses from an insurer. The business swimming pools customers' dangers to make payments more budget friendly for the guaranteed. The majority of people have some insurance policy: for their auto, their home, their medical care, or their life.Insurance likewise assists cover prices associated with obligation (lawful responsibility) for damages or injury triggered to a third celebration. Insurance policy is an agreement (policy) in which an insurer compensates an additional versus losses from certain contingencies or hazards.

Investopedia/ Daniel Fishel Many insurance policy kinds are offered, and practically any kind of private or business can discover an insurance policy firm eager to guarantee themfor a rate. Usual individual insurance plan kinds are auto, health, homeowners, and life insurance policy. A lot of individuals in the United States contend the very least among these kinds of insurance coverage, and auto insurance is required by state regulation.

The Facts About Pacific Prime Revealed

Discovering the price that is appropriate for you calls for some research. Maximums might be set per duration (e.g., annual or policy term), per loss or injury, or over the life of the plan, also understood as the life time optimum.

Plans with high deductibles are generally more economical due to the fact that the high out-of-pocket cost typically causes less tiny claims. There are several various types of insurance policy. Allow's take a look at the most important. Medical insurance helps covers regular and emergency medical treatment expenses, commonly with the alternative to include vision and dental services independently.

Numerous precautionary solutions might be covered for totally free before these are fulfilled. Health insurance policy may be bought from an insurance business, an insurance policy agent, the federal Health Insurance policy Market, given by an employer, or federal Medicare and Medicaid coverage.

Rumored Buzz on Pacific Prime

Instead of paying out of pocket for car crashes and damage, people pay annual costs to an automobile insurer. you could try this out The business after that pays all or the majority of the covered prices connected with an automobile mishap or various other vehicle damages. If you have a leased car or borrowed cash to buy a cars and truck, your lender or leasing dealership will likely need you to bring vehicle insurance policy.

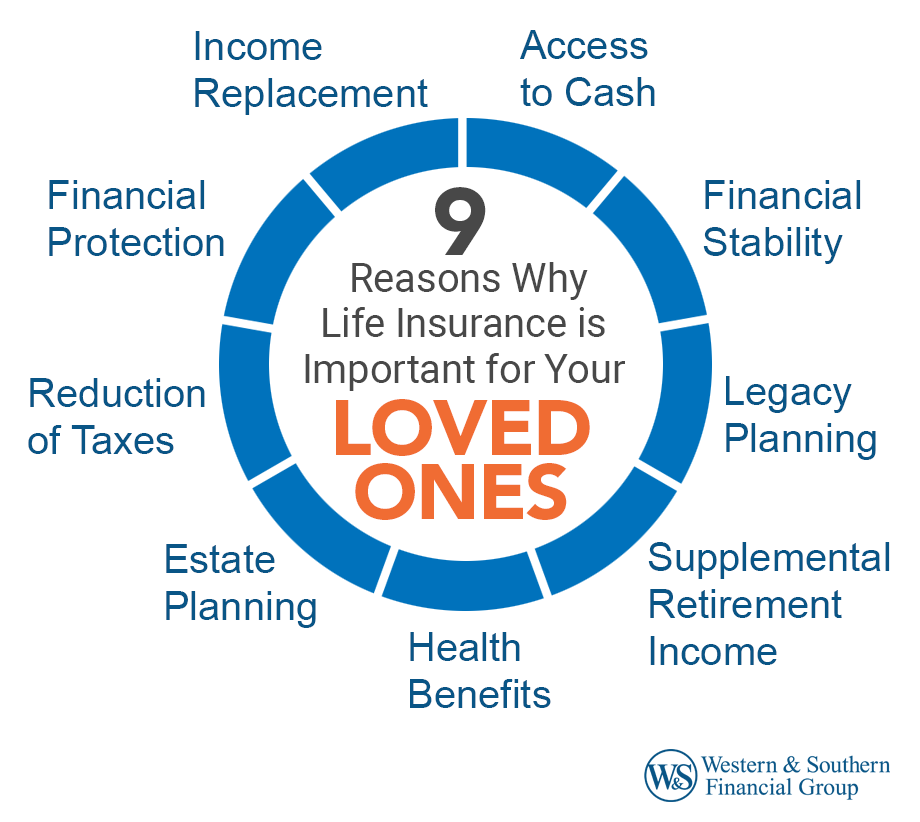

A life insurance policy assurances that the insurer pays a sum of money to your beneficiaries (such as a partner or youngsters) if you die. In exchange, you pay premiums during your life time. There are 2 main sorts of life insurance policy. Term life insurance coverage covers you for a details period, such as 10 to twenty years.

Long-term life insurance policy covers your whole life as long as you proceed paying the costs. Travel insurance coverage covers the costs and losses connected with traveling, consisting of trip cancellations or delays, insurance coverage for emergency situation health care, injuries and emptyings, harmed baggage, rental automobiles, and rental homes. However, even several of the best travel insurance firms - https://qualtricsxmxkzkppyv7.qualtrics.com/jfe/form/SV_9u8Yr9IFs6bVle6 do not cover terminations or delays due to weather, terrorism, or a pandemic. Insurance coverage is a method to handle your monetary risks. When you buy insurance policy, you purchase security versus unforeseen financial losses. The insurance provider pays you or somebody you select if something negative takes place. If you have no insurance policy and an accident occurs, you may be liable for all associated prices.

Some Of Pacific Prime

There are several insurance coverage policy types, some of the most common are life, health and wellness, property owners, and car. The ideal sort of insurance for you will certainly rely on your goals and monetary situation.

Have you ever before had a moment while looking at your insurance coverage or purchasing insurance policy when you've thought, "What is insurance policy? And do I really need it?" You're not alone. Insurance policy can be a mystical and puzzling thing. Just how does insurance coverage job? What are the advantages of insurance policy? And how do you find the ideal insurance for you? These prevail concerns, and fortunately, there are some easy-to-understand responses for them.

Suffering a loss without insurance policy can put you in a tough economic scenario. Insurance is an important economic device.

Not known Facts About Pacific Prime

And sometimes, like car insurance coverage and employees' settlement, you may be needed by law to have insurance in order to secure others - global health insurance. Find out about ourInsurance options Insurance is essentially an enormous wet day fund shared by many individuals (called insurance holders) and taken care of by an insurance provider. The insurer makes use of money gathered (called premium) from its policyholders and various other financial investments to pay for its procedures and to meet its assurance to insurance holders when they sue

Report this page